For decades, Europe’s energy system relied heavily on one source: cheap and abundant Russian gas and oil. However, the 2022 war made it clear that economic stability cannot be built on geopolitical dependence. Since then, the continent has been moving at historic speed toward renewable energy and self-sufficiency. The key question is: is Europe truly becoming stronger through energy independence?

How did Europe’s energy dependence on Russia develop, and why is it risky?

By the 2000s, the European Union (EU) had become largely dependent on Russian pipeline gas supplies. Major pipelines such as Yamal, Nord Stream, and the Ukrainian transit routes played a crucial role, accounting for more than 40% of the continent’s natural gas supply. These routes ensured that European industries and households could rely on the “steady flow of molecules” year after year.

Although this structure appeared economically advantageous, it also created political vulnerability: heavy cooperation with a single major supplier increased the risk of supply and price volatility. The EU’s response in 2022 included a ban on seaborne Russian crude oil imports (December 2022) and an embargo on refined petroleum products (February 2023), thereby structurally shifting away from the previous model. Eurostat

The decline of Russian gas and oil imports (2021-2024)

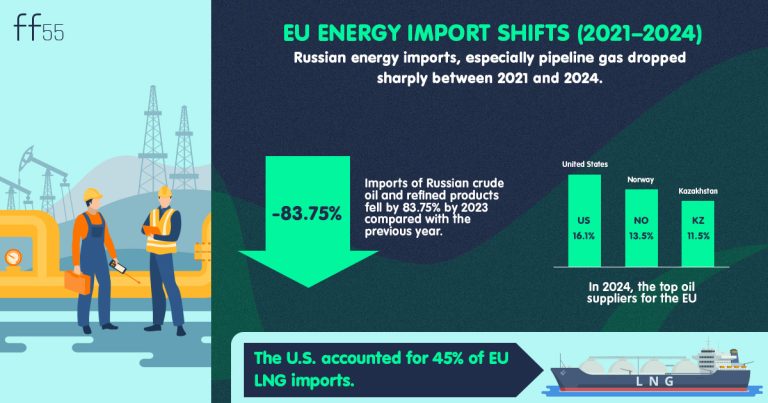

Energy import patterns have shifted significantly. According to Eurostat, the share of Russian energy imports, especially pipeline gas, declined sharply between 2021 and 2024.

Oil and refined product imports also fell steeply: by 2023, the volume of Russian crude and oil products imported to the EU had dropped by approximately 83.75 % compared with the previous year.

In 2024, the largest oil suppliers were the United States (16.1 %), Norway (13.5 %), and Kazakhstan (11.5 %), while the U.S. accounted for about 45 % of LNG imports.

Eurostat News, Voronoi

Alternative supply routes

Europe’s diversification efforts have involved several layers. The role of liquefied natural gas (LNG) has increased through new floating storage and regasification units (FSRUs) and import terminals. Norway has strengthened its position as a key pipeline supplier, while North Africa and Azerbaijan have gained importance in the mix.

According to the Agency for the Cooperation of Energy Regulators (ACER), EU LNG import capacity expanded by roughly 22 % between 2021 and 2023, and by another 7 % in 2024.

However, average terminal utilization rates fell from 58 % to around 42 %, indicating that flexibility, rather than capacity maximization, has become the new priority. ACER EMP

The environmental dilemma: rapid LNG build-out vs. renewables

While rapid LNG infrastructure expansion improved supply security, it also raised environmental and strategic concerns namely, the risk of a long-term “fossil lock-in.”

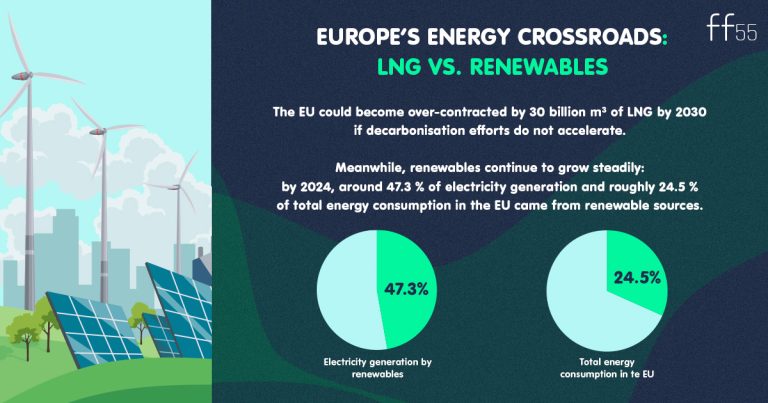

Analyses by ACER suggest that the EU could become over-contracted by 30 billion m³ of LNG by 2030 if decarbonisation efforts do not accelerate.Meanwhile, renewables continue to grow steadily: by 2024, around 47.3 % of electricity generation and roughly 24.5 % of total energy consumption in the EU came from renewable sources. Eurostat, European Commission, EMBER Energy

Challenges of the abrupt decoupling

The rapid shift away from Russian energy created significant short-term challenges in terms of supply security, prices, and industrial output.

In the second half of 2022, benchmark European gas prices (TTF) surged above €300/MWh, leading to temporary shutdowns in energy-intensive industries such as fertilizers, aluminium, and glass production.

According to the Bruegel think tank, EU countries spent on average 70% more on energy in 2022 than in the previous year, while household energy costs accounted for up to 30-40% of total inflation. European Commission

The European Commission’s State of the Energy Union 2023 noted that this period also improved system flexibility: total EU gas demand declined by about 17% between 2022 and 2023, partly due to demand-side responses and efficiency measures. While large-scale electricity blackouts were avoided, several member states including Germany, the Netherlands, and the Czech Republic temporarily restarted coal or oil-fired power plants to ensure backup capacity during the transition. European Commission,

Environmental impacts

The European Environment Agency (EEA) reported in 2024 that the decline in Russian pipeline imports, combined with the sharp rise in LNG use, temporarily increased the EU’s fossil-fuel emissions, since liquefaction and shipping are more energy-intensive processes.

Over its full life cycle, LNG can have 20-30% higher CO₂ intensity than pipeline gas.

However, the rapid growth of renewables led to a record reduction in energy-sector emissions: according to the EEA’s Greenhouse Gas Inventory 2024, total EU greenhouse-gas emissions fell by 5.4% year-on-year in 2023. European Parliament

The Commission’s Impact Assessment on REPowerEU (SWD/2022/230) projects that the plan could reduce emissions by 70-100 million tonnes of CO₂ annually in the long term, provided renewable capacity continues to expand as planned. Wikipedia

Overall, assessments suggest that the initial years of decoupling caused a short-term emission uptick, but the medium-term trajectory points toward faster decarbonisation and improved system resilience. European Environment Agency, European Commission

FF55 and REPowerEU, energy independence through the green transition

The Fit for 55 (FF55) package aims to reduce EU greenhouse gas emissions by at least 55 % by 2030 compared with 1990 levels. Within this framework, energy independence is understood not as a shift to new fossil suppliers, but as a structural reduction in fossil energy use, increased electrification, and expansion of clean technologies.

Launched in 2022, REPowerEU is the European Commission’s strategic plan to end dependence on Russian fossil fuels. It rests on three main pillars:

- Energy savings: lowering consumption in households and industry.

- Diversification of energy supply: establishing new, secure LNG, Norwegian, Azerbaijani, and North-African routes.

- Faster renewable deployment: simplifying permitting and accelerating solar and wind development.

According to the Commission, REPowerEU measures could reduce the EU’s annual energy import bill by more than €100 billion and raise the renewable share of the energy mix to 45 % by 2030. European Council, Supplyx, European Commission, REPowerEU

Summary

Europe’s energy landscape has undergone a fundamental transformation in just a few years. The shift away from Russian fossil fuels toward a diversified and low-carbon mix has changed both market structures and policy priorities. Alternative supply routes, energy-efficiency measures, and the rise of renewables have all contributed to a more resilient framework.

The ongoing challenge will be maintaining supply security while advancing decarbonisation balancing immediate energy needs with long-term sustainability goals.