What will you read about:

-

Explore the origins of the EU’s CO₂ quota system and why the automotive sector became its main focus.

-

Understand the legal framework, tightening targets, and the financial penalties shaping carmakers’ strategies.

-

See how credit trading creates winners and losers—why Tesla profits while traditional manufacturers “buy time.”

-

Uncover the paradox: is the system driving real innovation, or just clever accounting that delays true change?

The roots of the quota system: Why was it introduced?

The European Union is one of the key players in the fight against climate change. Since 1990, the EU has adopted several major legislative packages to reduce emissions, the most ambitious of which is Fit for 55. Its goal is to reduce greenhouse gas emissions by 55% by 2030 compared to 1990 levels.(European Commission, 2021)

Transport plays a major role: it accounts for about 15% of the EU’s total CO₂ emissions (European Environment Agency). That is why the automotive sector has become a central target of reforms.(European Environment Agency)

The essence of the CO₂ quota system is this:

- every manufacturer receives a fleet-wide average emissions target,

- those who stay below it generate surplus credits,

- those who exceed it must pay penalties or purchase credits from “better performers.”

In environmental economics, this is called a “cap-and-trade” system: there is an upper limit (the cap), but players can trade among themselves.

Everyday analogy: imagine that every apartment in a building has a monthly water consumption limit. If one household saves water, it can sell the “saved liters” to a neighbor who wastes more. The building’s total water use doesn’t rise, but the wasteful neighbors never really learn to save.

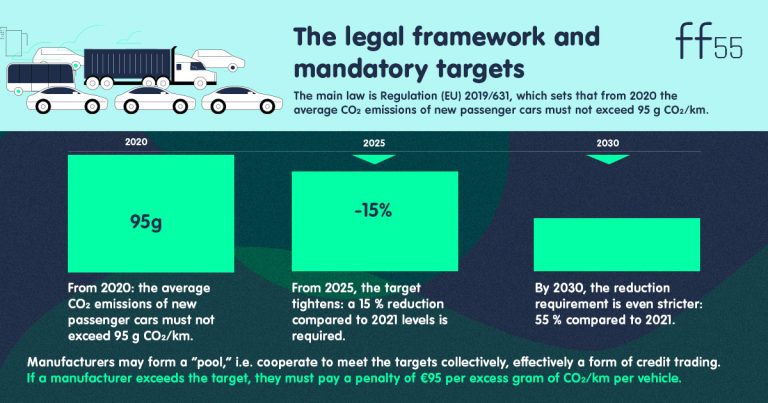

The legal framework and mandatory targets

The main law is Regulation (EU) 2019/631, which sets that from 2020 the average CO₂ emissions of new passenger cars must not exceed 95 g CO₂/km.

How does it work in practice?

Since 2021, the EU has a set limit of 95 g CO₂/km for the average emissions of new cars. This benchmark was so strict that many traditional manufacturers could not meet it. (Jones Day, 2024)

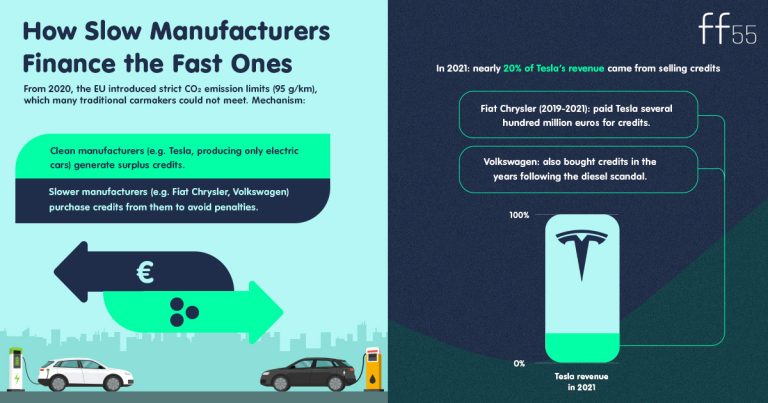

- Tesla, producing only electric cars, generates a huge amount of “surplus” credits. (Financial Times)

- Fiat Chrysler (now Stellantis) paid Tesla several hundred million euros between 2019 and 2021 to avoid penalties. (Reuters, 2019)

- Volkswagen also had to buy credits multiple times, especially in the transitional period after the diesel scandal. (Guardian, 2020)

This situation created a peculiar distortion in the system:

- The intention: all manufacturers should innovate.

- The reality: the less advanced ones often prefer to “buy time” from others.

In 2021, nearly 20% of Tesla’s revenue came from selling CO₂ credits (Financial Times). In other words, European manufacturers indirectly financed Tesla’s global expansion.

Quotas vs. actual emissions: data and criticisms

A study titled Shifting burdens: How delayed decarbonisation of road transport affects other sectoral emission reductions reported that in 2022 road transport fuel use accounted for about 760 million tons of CO₂, around 21 % of the EU’s emissions.

According to the European Environment Agency (EEA), the average CO₂ emissions of new passenger cars fell by 28 % between 2019 and 2023.

The European Commission Climate Action portal confirms a similar figure: a 27 % decrease between 2019 and 2022.

NGO Transport & Environment also highlights a 28 % drop since 2019.

This shows the regulation had an effect, but not exclusively through quota trading.

Criticism: the system allows dirtier manufacturers to buy credits instead of innovating, delaying real change. Reuters reports that Stellantis, Toyota, Ford, Mazda and Subaru plan to form pools with Tesla in 2025 to avoid penalties (Reuters, 2025).

Another Reuters article notes that from 2025, the fleet-wide average must fall to 94 g/km (from 116 g/km), with penalties of €95 per g/km per car if exceeded (Reuters, 2024).

ACEA (European Automobile Manufacturers’ Association) itself admitted that 2025 targets are a “make-or-break” moment, if not achieved, penalties or pooling strategies will be inevitable. (ACEA, 2025)

Without pooling/credit options, EU carmakers could face up to €15 billion in fines by 2025 (ESG News, 2025).

The core of the paradox

Although the system was designed to encourage manufacturers to adopt cleaner technologies, in practice a strange contradiction has emerged.

Instead of investing all their resources into development, European carmakers often prefer to “buy time” by purchasing credits from competitors. This way, they avoid fines in the short term, but at the same time, their rivals become even stronger.

Analogy: it’s like a marathon runner who falls behind the lead pack and, at each kilometer, pays one of the faster competitors to “hand over” a few minutes of their time. On paper, the result looks better, but in reality the runner hasn’t become faster, and the others’ lead just keeps growing.

Concrete reductions (Transport & Environment, 2024)

- New car emissions fell by about 28 % between 2019 and 2023.

- Targets set by law: -15 % by 2025, -55 % by 2030 (compared to 2021).

In terms of tons: (Shifting burdens… study, 2025)

- In 2022, road transport emissions as a whole were ~760 Mt CO₂.

- According to the ICCT, in 2023 there were 10.7 million new vehicles registered, with an average of 107 g CO₂/km.

- That equals around 1,145 million kg CO₂/km for the entire fleet of new vehicles, per km driven. If you multiply by average annual mileage, this becomes a massive figure.

But:

- Lab-tested emissions differ from real-world driving.

- The regulation only applies to new vehicles, not the entire fleet.

- Annual mileage varies widely across countries.

Conclusion

The CO₂ quota system is one of the most important tools in climate protection, but hidden within its operation lies a paradox: while the more polluting manufacturers escape penalties in the short term, they are in fact financing their competitors and thereby weakening their own position.

Our campaign aims to highlight exactly this contradiction: does the system bring genuine progress, or does it merely provide a costly reprieve that ultimately undermines Europe’s car industry?

Sources and refernces:

https://ec.europa.eu/commission/presscorner/detail/en/ip_21_3541

https://ec.europa.eu/commission/presscorner/detail/en/ip_21_3541

https://www.jonesday.com/en/insights/2024/12/new-co-emission-standards-for-cars-and-vans-in-the-eu

https://www.jonesday.com/en/insights/2024/12/new-co-emission-standards-for-cars-and-vans-in-the-eu

https://www.ft.com/content/aaf1a903-1936-4807-9fa0-6fbbe2485edb

https://arxiv.org/abs/2502.02809

https://www.eea.europa.eu/en/analysis/indicators/co2-performance-of-new-passenger