Electromobility and energy storage have become more than technological trends, they are now among the main drivers reshaping European industry. Battery factories with more than 50 gigafactories planned or under construction across Europe play a crucial role in the continent’s green transition. The Fit for 55 package, aiming for a 55% emissions reduction by 2030, can only succeed if electric systems dominate transport and energy. This requires a strong, competitive European battery industry.

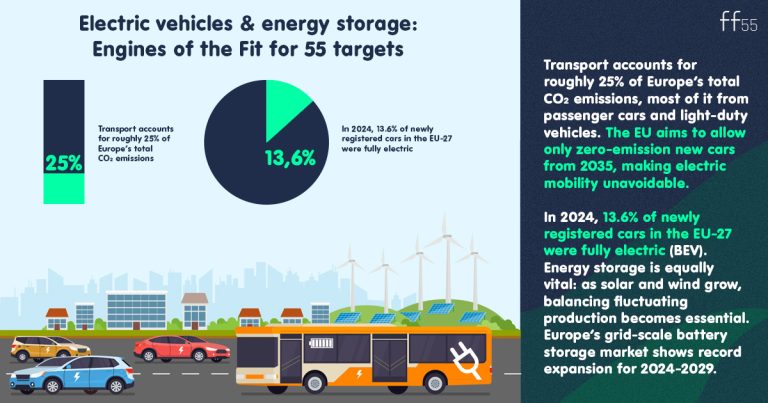

Electric vehicles and energy storage: Engines of the Fit for 55 targets

Transport accounts for roughly 25% of Europe’s total CO₂ emissions, most of it from passenger cars and light-duty vehicles. The EU aims to allow only zero-emission new cars from 2035, making electric mobility unavoidable. In 2024, 13.6% of newly registered cars in the EU-27 were fully electric (BEV). EEA

Energy storage is equally vital: as solar and wind grow, balancing fluctuating production becomes essential. Europe’s grid-scale battery storage market shows record expansion for 2024-2029. SolarPower Europe Battery factories therefore support not only the car industry, but Europe’s entire energy infrastructure.

Battery manufacturing within the Net-Zero Industry Act

Under the Net-Zero Industry Act, the EU aims to ensure that clean technologies including battery cells are manufactured sustainably and competitively within Europe. The goal: at least 40% of strategic clean-tech production must take place inside the EU to reduce dependency on foreign suppliers. Transport & Environment

Today, more than 75% of global battery production comes from Asia. Without European manufacturing capacity, the green transition would lead to deep import dependency. European Parliament Research Service, EUR-LEx

Positive impacts: Jobs, innovation, climate Benefits

A single gigafactory can create 2000-3000 direct jobs, plus thousands more in supplier networks. It often has similar economic effects to a new urban transport line: new service centers, restaurants, logistics firms and technology suppliers emerge, revitalizing local economies.

Battery innovation is among the fastest-advancing industries worldwide. Energy density has nearly doubled in the past decade, and solid-state batteries may disrupt the market within years. Europe’s annual cell manufacturing capacity is already around 190 GWh. IPCEI Batteries

Producing batteries locally also cuts emissions: EU-made cells can have 20-40% lower CO₂ footprint than Chinese-produced equivalents. Mobility portal, ScienceDirect

Challenges: water usage, energy demand, raw material sustainability

The challenges, however, are real. Manufacturing, especially cooling and cleaning, requires significant water: some plants use millions of gallons per day. Battery Tech Online

Energy demand is another critical factor: a gigafactory’s annual electricity usage can rival that of a small city. If not powered by renewables, the environmental gains shrink.

Raw material sustainability, lithium, nickel, cobalt is also a concern. The EU pushes for a circular economy: by 2030, batteries should contain at least 6% recycled lithium and 10% recycled nickel and cobalt. European Parliament, European Council

Fit for 55: More than emissions reduction

Fit for 55 is not only about reducing emissions. It aims to build an industrial ecosystem where green technology is also manufactured locally and sustainably. Battery factories are therefore not just production hubs; they are foundational pillars of Europe’s future clean economy.

In the coming years, Europe’s industry will transform: fewer fossil fuels, more renewables, more electric vehicles all supported by a new strategic sector: battery manufacturing. The question is no longer whether Europe needs this capacity, but how quickly and responsibly it can build it.